Three large credit-reporting companies have decided to erase credit stains on Americans’ credit reports related to certain medical debts, thus alleviating the pressure on their credit score since such bills don’t reflect a consumer’s financial behavior.

“As an industry, we remain committed to helping drive fair and affordable access to credit for all consumers,” say the chief executives of Equifax, Experian, and TransUnion. Together, they keep on file 200 million citizens.

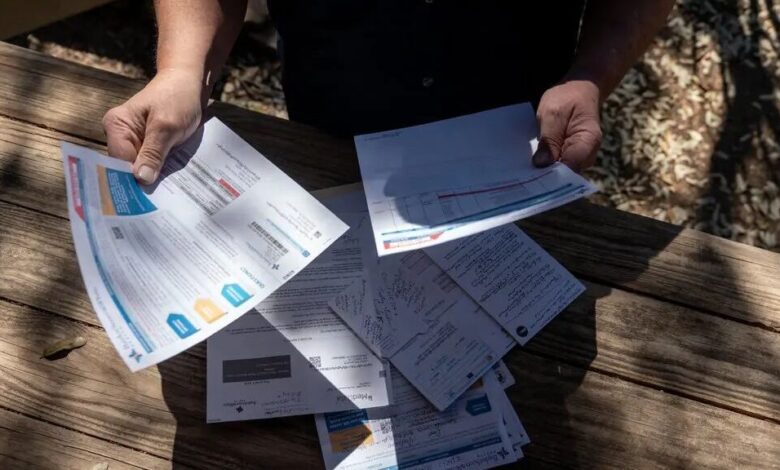

As of July 1, all medical debts paid after they went to collections will be erased from credit reports. Through that change, 70% of medical debts will disappear and no longer be used to calculate the three-digit credit score required to obtain a mortgage, a car loan, or a rental agreement. Also, all new medical debts will only appear a full year after being sent to collections — instead of six months — so consumers have more time to sort out payments. As for unpaid medical collection debts under $500, including co-pays and deductibles, they will be excluded starting in early 2023. The changes come in the wake of the Consumer Financial Protection Bureau’s intention to scrutinize the credit companies’ treatment of medical debt and to ban including medical debt in credit reports.